⏱ Today's Read: 6 Minutes

Introduction

Money plays an important role in society. It allows the value of standardized value of goods and services, making transactions simpler and more efficient. That means I don't have to pay you a barrel of oil for a sandwich. I use money, which has an agreed upon value to help the trade.

Additionally, money serves as a store of value, helping people save and defer consumption to the future. It measures value and allows individuals, businesses, and governments to decide what to buy.

The Emergence of Money

The start of money emerged from the primal necessity to create a simplified system of exchange. In the earliest societies, trading goods and services was way of the barter system. Bartering involved the direct exchange of goods or services for other goods or services without using a medium of exchange, such as money. This primitive system, was fraught with limitations - the most critical being the double coincidence of wants. The problem lies in finding two people who each have what the other wants and are willing to part with it.

The imperfections of the barter system led to a version of commodity money. Certain commodities are desirable due to their scarcity, divisibility, durability, and portability. Early societies used objects such as seashells, beads, and even cattle as forms of money.

Metal emerged as an ideal form of money around 5000 BC. It was durable, divisible, and scarce enough to have value but found in enough quantities to be useful. The Lydians minted the first metallic coins around 600 BC. Gold and silver coins became a universal currency in the advanced civilizations of Rome and Greece. Their acceptance was due to the value of the metal itself. The system also allowed for a degree of standardization and control over the monetary supply.

The emergence of paper money marked a pivotal point in the evolution of money. We can trace the first instances of paper money back to China during the Tang Dynasty, around 618 AD. Paper money offered a significant advantage over coins due to ease of handling large transactions. Yet, it also brought a new set of challenges. The value of paper money is not based on the value of the paper, but on the trust and promise of the issuing authority. Counterfeiting and inflation then became issues of concern.

The transition to banknotes, or 'fiat' money, occurred when banks began issuing notes that were redeemable in gold or silver. This system later evolved, and most modern fiat currencies are no longer backed by physical commodities. Each progression in the history of money was a solution to the problems of the preceding form. The story of money is one of innovation and adaptability. Money, as we know it today, is a testament to society's continuous strive for a more efficient, secure, and fair system of exchange.

Why the Type of Money Matters

The type of money has varied across geography and depending on resources available. That money then has progressed or destroyed societies. Money has evolved over the course of human history and depending on the society, has been many different goods including:

- Gold and Silver: Due to their scarcity and durability, people used precious metals as a medium of exchange for thousands of years.

- Seashells: Cultures in Africa, the Americas, and Asia, used cowrie shells.

- Salt: Valued for its use in food preservation, it's where the word "salary" originates from.

- Livestock: In pastoral societies, cattle and sheep often served as a measure of wealth and medium of exchange.

- Beads: Beads, like wampum used by Native American tribes, have served as currency.

- Cocoa Beans: Ancient Aztec and Mayan civilizations used Cocoa Beans as currency.

- Tea: The Chinese used tea bricks as a form of currency in Ancient times.

- Tobacco: During colonial times in America, people used tobacco leaves as a form of currency.

- Peppercorns: Used as currency in the Middle Ages and were even considered as valuable as gold.

- Rai stones: Large circular stone disks were a form of currency in the Micronesian island of Yap.

As you can tell, some of these goods are more scarce than others. For example, when Europeans came to Africa and saw that the main currency were beads, they made more beads. They seemed rich, but all they did was inflate the money supply. In the short term, Europeans were able to trade more beads to get more resources. Over time, because of the sharp increase in bead supply, it first caused prices to increase, then it rendered the currency worthless. Thus we can tell that scarcity in money is critical. We can't trade sand in jars because everyone could go get more sand from the beach.

The divisibility of money is as important to ease trade over time and space. This was clear with Rai stones on the island of Yap. These were large rare stones that worked as a ledger of sorts to say what family had how much money. They were hard to replicate, but hard to transport. You couldn't buy a meal or an animal skin for a Rai stone. They tracked those smaller transactions and then roll them up to the larger ledger of the stone. At the end of the day, money is a ledger- it keeps track of who owes what, and what you owe or have.

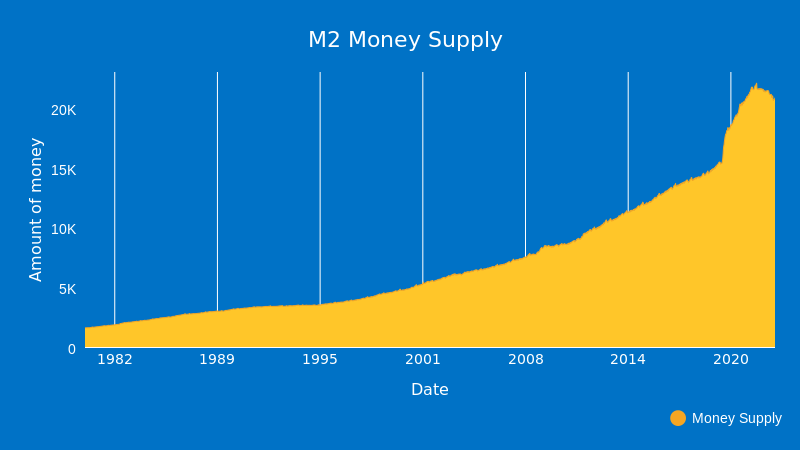

Today, there are over 180 national fiat currencies that nations issue. Before, issuers based these currencies on a scarce commodity like gold. Lately, they have been releasing them without gold backing, only backing it with trust. This means that depending on market conditions, countries have the power to expand or contract the money supply leading to more dramatic credit and business cycles. Weimar Germany in 1923, Zimbabwe in 2008, and Venezuela in 2016, saw the sudden expansion of the money supply by centrals banks, rendering the currency worthless. These are a few of the countless examples of paper currency hyperinflation.

Having money that is a neutral and scarce commodity has also helped countries avoid sanctions from other countries. If the value of the currency fluctuates, its value is unknown so the unit of account can become distorted. $5 might now mean $10 and vice versa. This level of stability is important for the 'store of value' concept of money. The energy required to refine (like mining gold) or discover money is important to giving it value. If it's easy to find and easy to discover, it's not worth a lot.

Digital Money and the Future

An anonymous entity known as Satoshi Nakamoto introduced Bitcoin, a type of digital currency, to the world in 2009. Unlike currencies issued by central banks, Bitcoin operates on a decentralized system called a blockchain. The blockchain is a public, distributed ledger of all Bitcoin transactions, maintained by a network of computers worldwide, making it secure and resistant to fraud. No one single entity 'owns' Bitcoin as the code is open source, like a public utility. For a more direct comparison to the internet, Bitcoin is the like the TCP/IP of value- Bitcoin is an open source protocol that allows anyone to transfer and receive value.

Satoshi created Bitcoin to solve the problems with traditional fiat currencies. They designed Bitcoin with a limited supply of 21 million coins to prevent inflation issues that are common with fiat currencies. This finite supply, akin to gold's scarcity, can preserve Bitcoin's value over time. It also requires 'hashing' algorithms to mine the coins, which requires a significant amount of power, so not anyone can get more bitcoin. You need to put in the 'work' to get it- similar to commodity money. As adoption of the currency occurs, bitcoin becomes more and more difficult to mine.

As a digital currency, anyone can send or receive Bitcoin anywhere in the world, at any time, without needing a third-party intermediary such as a bank. This makes transactions faster and cheaper, particularly for international transfers.

Bitcoin represents a significant evolution in our concept of money. It combines economics, cryptography, and decentralization to offer a form of money designed for the digital era, empowering individuals all around the world.

You might say, well we have digital dollars what's the need? If you want to preserve value over a long time horizon, you have to trust that central banks won't increase the money supply and devalue dollars. In response to the 2008 financial crisis, Satoshi designed Bitcoin as a lifeboat to the legacy fiat financial system. It is open to everyone and not-censorable, providing a level of equity not seen before.

Conclusion

Bitcoin has existed for 14 years and as a new monetary asset it volatile in the short term as it monetizes, but over time has shown great promise. Bitcoin is the 20th largest currency in the world, behind the Singapore dollar and the United Arab Emirates Dirham. Like gold, bitcoin is a money that is not controlled by governments. This allows people across the world who are un-banked or do not have access to legacy finance can send value as they need it.

Money has a complicated, oppressive and changing history. As society progresses, people create new versions of monetary technology fit for the need of the time. This has taken shape as seashells, salt, gold, dollars, and now Bitcoin in the digital age. There will be many types of money, but based on the properties of the currency (medium of exchange, store of value, unit of account), some are better than others.